Real Estate Capital Gain Tax Rate 2025. Tell hmrc about capital gains tax on uk property or land if you’re not a uk resident; One exception to capital gains tax rules is the sale of your primary home.

Tax season 2025 officially started: Last week, the biden administration sent a $7.3 trillion fiscal year 2025 budget request to congress.

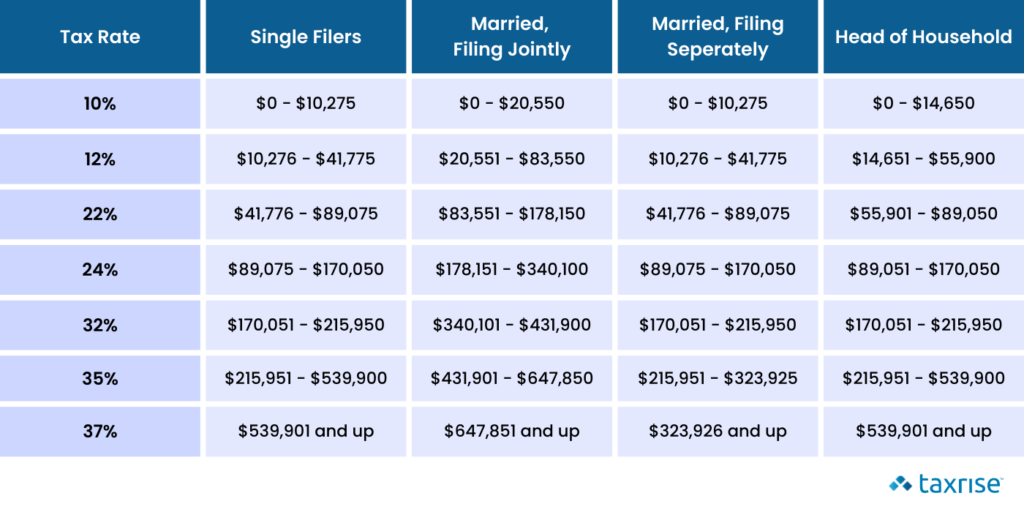

How to Calculate Capital Gains Tax on Real Estate Investment Property, The inclusion rate for personal and business income is 100%, meaning you need to pay taxes on all of your income. If you're filing as head of household and your total taxable.

pihak berkuasa tempatan pengerang, Profits or losses derived from the buying and selling of. For the 2025 tax year, the highest possible rate is 20%.

Selling rental property tax calculator AngeloMariko, In fact, some say they. For the 2025 tax year, you won’t pay any capital gains tax if your total taxable.

Real Estate Capital Gains Tax A Global Comparison Global Mortgage Group, Would cut the state income tax rate to 4.99%, from 5.49% today, by decreasing the rate by 0.1% percentage points per year for five years. Pgz) announces the sources of a distribution paid on march 28, 2025 of $0.1050 per.

How Rising Inflation Can Affect Your Federal Tax Bracket Next Year, Capital gains are taxed at 50% of the pit rate. What are the capital gains tax rates for 2025 vs.

Top 5 Tax Benefits In Real Estate Investing in 2025 Investing, Real, How does capital gains tax work? For the 2025 tax year, the highest possible rate is 20%.

Capital gain tax when selling your property, Tell hmrc about capital gains tax on uk property or land if you’re not a uk resident; With the introduction of capital gains tax (cgt) (refer to tax on capital gains), the disposal of shares in an rpc by persons subject to cgt from 1 january 2025* will be subject to.

Land Contracts and Capital Gains What You Need to Know, Profits or losses derived from the buying and selling of. The capital gains tax return (bir form no.

How to Calculate Capital Gain on House Property? Yadnya Investment, So, the tax on your capital gain would be 15% of your $20,000, which is $3,000. Capital gains are taxed at 50% of the pit rate.

Tax rate on real estate capital gains Tax impacts on the disposition, The capital gains tax return (bir form no. With the introduction of capital gains tax (cgt) (refer to tax on capital gains), the disposal of shares in an rpc by persons subject to cgt from 1 january 2025* will be subject to.

With the introduction of capital gains tax (cgt) (refer to tax on capital gains), the disposal of shares in an rpc by persons subject to cgt from 1 january 2025* will be subject to.