Kansas Mileage Reimbursement Rate 2025. These reimbursement rates are considered to cover all costs associated with the. The irs mileage rate in 2025 is 67 cents per mile for business use.

Rates are set by fiscal year, effective oct. View the job description, responsibilities and qualifications for this position.

Free Mileage Log Templates Smartsheet (2025), Transportation (airfare rates, pov rates, etc.) privately owned vehicle (pov) mileage reimbursement rates. View the job description, responsibilities and qualifications for this position.

IRS Mileage Rate for 2025 What Can Businesses Expect For The, 67 cents per mile (up from 65.5 cents for 2025) may be deducted if an auto is used for business. Effective july 1, 2019, the state of kansas changed the standard mileage reimbursement rate for employees to align with changes implemented by the internal revenue service (irs) for.

The IRS mileage rates for 2025 Kansas City Business Journal, Gsa has adjusted all pov mileage reimbursement rates. The irs rate for privately.

IRS Announces 2025 Mileage Rates, Rates are set by fiscal year, effective oct. This rate reflects the average car operating cost, including gas, maintenance, and depreciation.

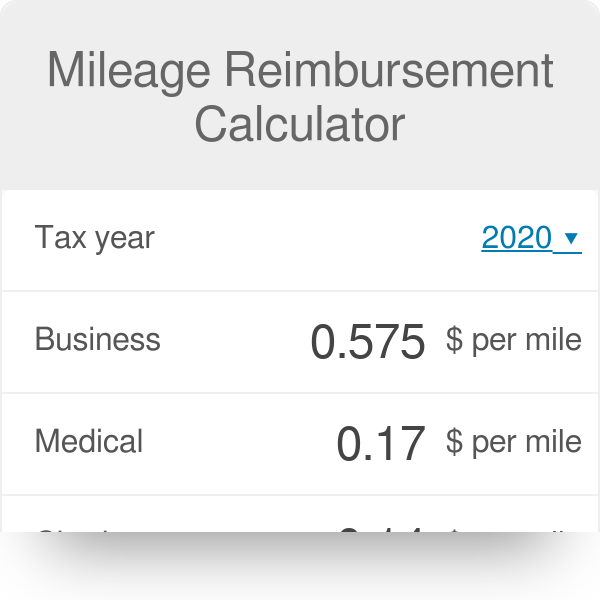

Calculate gas mileage reimbursement AmandaMeyah, Effective july 1, 2025 the state of kansas increased the standard mileage reimbursement rate for employees, to align with changes implemented by the internal revenue service (irs) and. The irs mileage rate in 2025 is 67 cents per mile for business use.

IRS Standard Mileage Rates ExpressMileage, 67 cents per mile (up from 65.5 cents for 2025) may be deducted if an auto is used for business. Effective july 1, 2019, the state of kansas changed the standard mileage reimbursement rate for employees to align with changes implemented by the internal revenue service (irs) for.

2025 standard mileage rates released by IRS, The 2025 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year. The irs mileage rate in 2025 is 67 cents per mile for business use.

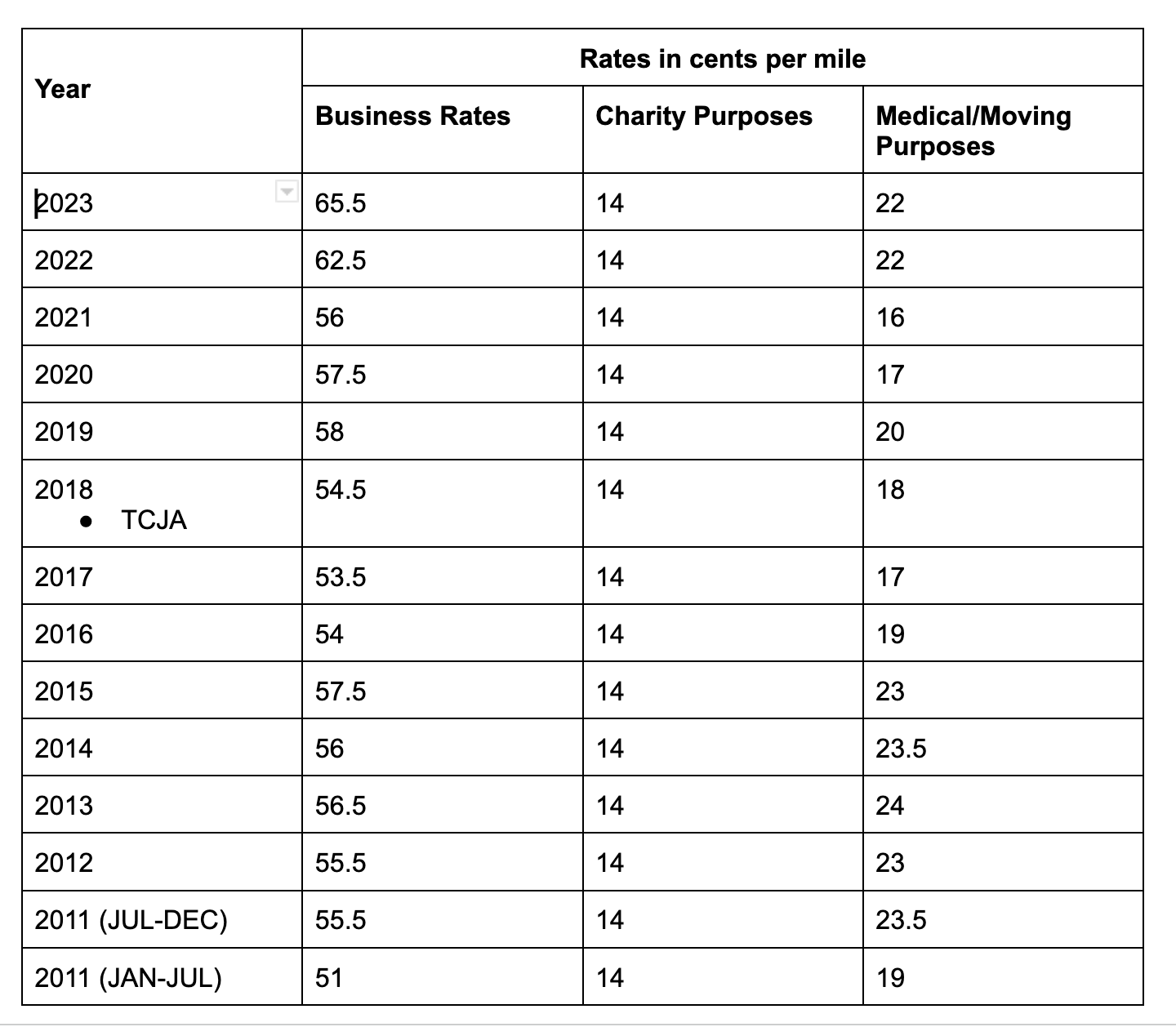

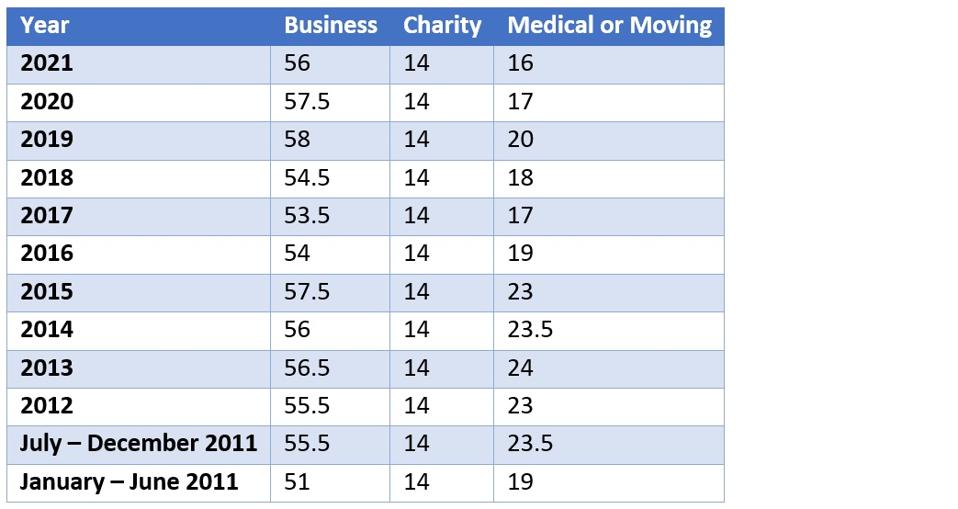

Table showing historical IRS mileage rates, Transportation (airfare rates, pov rates, etc.) privately owned vehicle (pov) mileage reimbursement rates. The internal revenue service (irs) has announced changes in the standard mileage rates effective january 1, 2025.

Mileage Reimbursement Form in PDF (Basic) / Mileage Reimbursement Form, Effective july 1, 2019, the state of kansas changed the standard mileage reimbursement rate for employees to align with changes implemented by the internal revenue service (irs) for. Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel.

Cardata The IRS announces a new mileage rate for 2025, Mileage is to be reimbursed at $.43 for autos, $.30 for motorcycles, and $1.07 for airplanes. Gsa has adjusted all pov mileage reimbursement rates.

Effective july 1, 2019, the state of kansas changed the standard mileage reimbursement rate for employees to align with changes implemented by the internal revenue service (irs) for.